If you had a transfer or rollover to your Schwab retirement account s a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD. The SECURE Act did not change how the RMD is calculated.

Readers Still Struggle With The Secure Act S New Age 72 Rmd Rule

If you were born before 711949 the age remains 70 12.

Rmd calculator birthday. If you have multiple IRAs you must calculate each account individually but you can take your total RMD amount from one IRA or a combination of IRAs. If it is helpful I have another excel file online that has a future value calculator. Call us at 866-855-5636.

70 born after June 30th. If you were born on or after 711949 your first RMD will be for the year you turn 72. Previous Year-End IRA Balance.

The Uniform Lifetime Table is used to calculate lifetime RMDs. The RMD Calculator compares the Primary Beneficiarys year of birth to the Successor Beneficiarys year of birth. The SECURE Act of 2019 changed the age that RMDs must begin.

Your 70th birthday was July 1 2019. Determining how much you are required to withdraw is an important issue in retirement planning. Individuals who reach 72 in 2021 and their 70 th birthday was July 1 2019 or later have their first RMD due by April 1 2022.

Your date of birth is used to determine if a required minimum distribution RMD is due for the year and if so to determine the applicable life expectancy factor for this RMD calculation. For traditional IRAs no adjustments are made for contributions or distributions after that date. April 1st of the year after you reach 72.

Owners of traditional Individual Retirement Arrangements IRAs Owners of traditional Simplified Employee Pension SEP IRAs. Your 70th birthday was June 30 2019. If you were born before 711949 the age remains 70 12.

The SECURE Act did not change how the RMD is calculated. You must take your first RMD for 2019 by April 1 2020. The SECURE Act of 2019 changed the age that RMDs must begin.

There is no RMD for 2020 due to the Coronavirus Aid Relief and Economic Security CARES Act RMD Waiver. The only way to use it before you are 70 12 is to estimate the size of your 401kIRA when you become 70 12 and change your birthday to the date you will become 70 12. Date of Death mmddyyyy.

The Setting Every Community Up for Retirement Enhancement SECURE Act of 2019 raised the age when you must begin taking RMDs from a traditional 401kor IRAfrom 70½ to 72. You reached age 70½ on December 30 2019. The Calculator assumes earnings on each account are reinvested on December 31 of each year.

Your Date of Birth. The RMD program is only set up to calculate your RMD at various stages after 70 12. If you turn age 70 ½ after 2019 your RMDs generally must begin after age 72.

You will then need to take a second RMD by December 31 2021 of that same year. Account balance as of 1231 of year prior to distribution year. The algorithm of this RMD calculator performs the following steps.

While you must take your RMD by December 31st of every year you can delay taking your first RMD until April 1st of the year after you reach 72. If you were born after June 30 1949 you must start taking RMDs by April 1 of the year after you turn 72. The SECURE Act of 2019 changed the age that RMDs must begin.

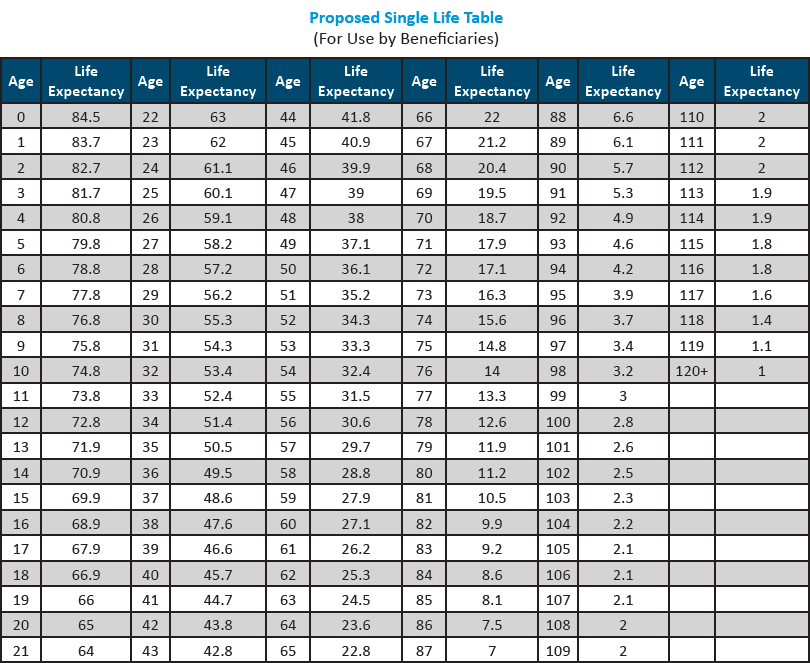

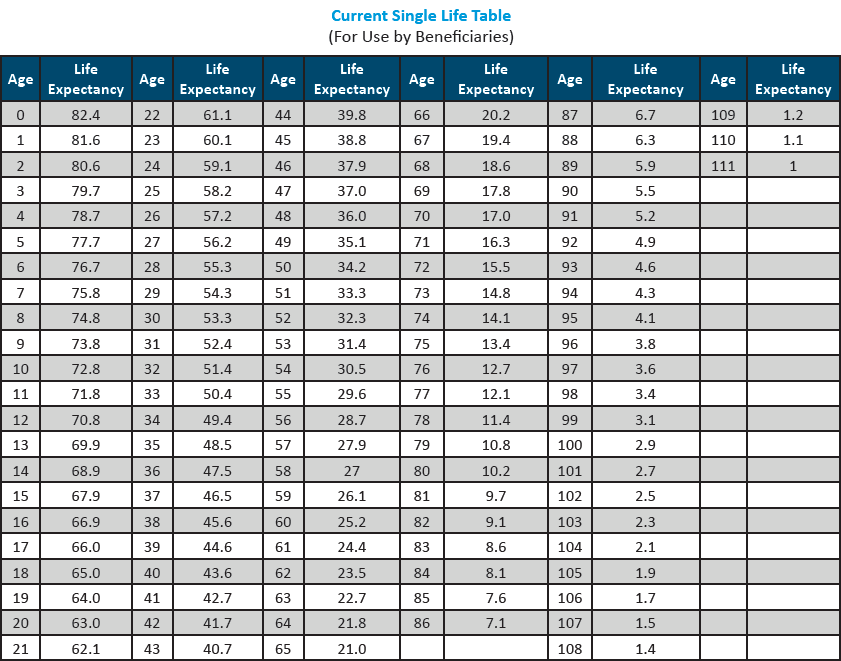

As it can be observed the distribution factor depends on the beneficiarys age. You reached age 70½ on January 1 2020. The required distribution rules apply to.

These amounts are known as your Required Minimum Distributions RMD. Required Minimum Distribution Calculator SECURE Act Raises Age for RMDs from 70½ to 72. Use this calculator to determine your.

You must take the RMD by April 1 2022. Youll have to take another RMD on. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

What you need to know about RMDs Age requirements With Traditional IRAs you are required to take annual RMDs starting at age 72. There is no IRS guidance yet on the definition of not more than 10 years younger. However the first RMD must be withdrawn by April 1 st 2021.

Use the RMD calculator to find your RMD amount. Lets say you celebrated your 72nd birthday on July 4 2021. Your 72nd birthday is November 1 st of 2020.

If you were born on or after 711949 your first RMD will be for the year you turn 72. Use this calculator to determine your current RMD and estimate your future RMDs. Same as IRA rule.

This is the fair market value of your account as of the close of business on December 31st of the preceding year. The SECURE Act of 2019 changed the age that RMDs must begin. Maximum age for this tool is 110.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. - It first finds the age of the beneficiary. Calculate your RMD amount Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors.

How to Calculate Required Minimum Distribution RMD Javier Simon CEPFOct 12 2021 Share Required minimum distributions RMDs are withdrawals you have to make from most retirement plans excluding Roth IRAs when you reach the age of 72 or 705 if you were born before July 1 1949. If you made a transfer or rollover from one account on or before. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

The Calculator does not consider the effect of taxes on the RMD withdrawn and the amount owed in taxes on the withdrawal is not calculated. Sometimes FMV and RMD calculations need to be adjusted after December 31. If you were born on or after 711949 your first RMD will be for the year you turn 72.

The Joint and Last Survivor Table is used instead of the Uniform Lifetime Table when your spouse is the sole beneficiary and is more than 10 years younger than you. If you were born before 711949 the age remains 70 12. What is the deadline for taking.

If this applies to you you have as late as April 1 of the year following the. If you were born before 711949 the age remains 70 12. You can take your first RMD by December 31 st 2020 or you can wait to take your first RMD until 2021.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. The difference Successor Beneficiarys year of birth - Primary Beneficiarys year of birth must be greater than 0 and less than 11. Prior Year-End Account Balance Date of birth MMDDYYYY.

Original Account Holder Date of Birth mmddyyyy. You must take your first RMD by April 1 2022. If you were born on or after 711949 your first RMD will be for the year you turn 72.

The Calculator assumes the RMD for each year is withdrawn on December 31 of each year for which an RMD is required. Your date of birth. Required Minimum Distribution RMD The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually starting the year you turn age 70-12.

- Then it divides the previous year end balance by the distribution factor given below. The SECURE Act changed the age requirement from 70 ½ to 72 meaning anyone whose birthday falls on or after July 1 2019 has until age 72 to take hisher first RMD.

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

After Death Required Minimum Distribution Rules After The Secure Act Dbs

What Is A Required Minimum Distribution Taylor Hoffman

Required Minimum Distribution Rmd Excel Cfo

The Double Whammy Of Required Minimum Distribution In A Recession By Anthony Lawrence Wrong Wrong Wrong Medium

2019 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Addition To Required Minimum Distribution Excel Cfo

Required Minimum Distribution Calculator

After Death Required Minimum Distribution Rules After The Secure Act Dbs

Rmds Required Minimum Distributions Top Ten Questions Answered Mrb Accounting 516 427 7313

Rmds Tis The Season For Required Minimum Distributions

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

Required Minimum Distribution Rmd 3 0 Excel Cfo

Recently Turned 70 And 1 2 Don T Miss The Rmd Deadline Money

Required Minimum Distribution Rules Sensible Money

Rmds Tis The Season For Required Minimum Distributions

What Is A Required Minimum Distribution Taylor Hoffman

What Are The Required Minimum Distribution Rules For Lifetime Distributions After The Secure Act Dbs

Post a Comment